What is the $LUMIA token?

LUMIA Token Overview

Introduction

As Lumia evolves into the first full-cycle RWA chain and decentralized finance, with a native token $LUMIA.

LUMIA Token Utility

- Native Gas Token: Used to pay transaction fees on the Lumia Layer 2, built with EIP compatibility for seamless operations.

- Governance: Token holders can participate in platform governance by locking LUMIA to obtain LUMIAp. LUMIAp is a governance derivative that reflects two things: how much $LUMIA you’ve locked and how long you’ve locked it. This dual metric determines your voting weight and access to ecosystem rewards just like its predecessor, veORN.

- Every LUMIAp lock of 3 months or more qualifies for a share of each upcoming EcoDrop — exclusive airdrops of ecosystem tokens from projects launching on LUMIA. The more LUMIAp you hold, the larger your allocation across every EcoDrop.

- Node Staking: Stake LUMIA to support network security and earn rewards.

- Liquidity Provision: Provide liquidity across the Lumia ecosystem to potentially earn pool rewards and benefits.

- Access to Premium Features: Holding LUMIA may grant reduced fees, exclusive platform features, and eligibility for future ecosystem airdrops.

Strategic Importance of LUMIA

- Aligned Incentives: As both a gas and utility token, LUMIA brings together the interests of developers, users, and the network.

- Economic Security: Node staking with LUMIA enhances security and decentralization.

- Ecosystem Growth: Broad token utility promotes long-term holding and active participation.

- RWA Enablement: LUMIA is key in facilitating tokenized real-world asset integration and exchange.

- Cross-Chain Compatibility: LUMIA powers interoperability and liquidity across multiple blockchains.

Tokenomics

- Current ORN Supply: 92,631,255

- New LUMIA Supply: 238,888,888

- Supply Increase: 146,257,633

Why the Increase in Token Supply?

The original ORN token model, built for Orion’s earlier use cases, no longer supports the broader vision of Lumia. As we shift toward a liquidity-centric Layer 2 designed for RWAs, we need a token economy that matches our scale and ambition.

Key reasons for the expanded supply:

- Node Rewards: To incentivize node operators who secure and support Lumia Stream’s liquidity network.

- Community Growth: Airdrops, grants, and rewards for users, builders, and early adopters are crucial to ecosystem adoption.

- Zero Team Allocation: 100% of new tokens go to the community—none to the team.

- Long-Term Vesting: All new tokens are vested over 20 years to ensure sustainable distribution.

Core Drivers Behind the Tokenomic Shift

- Ecosystem Kickstart

To grow a thriving L2, incentives are key—airdrops, dev grants, liquidity mining, and validator rewards are vital components. - Liquidity Node Incentives

Lumia Stream’s liquidity network needs incentives to attract and reward node operators and delegators, building deep liquidity across chains. - Sustainable Fees

The larger supply enables:- Micro-transactions

- Balanced fee models

- Future token burn mechanics as network usage grows

- Governance & Staking

Broader token distribution improves decentralization, boosts community participation, and creates larger staking pools. - Cross-Chain Operations

More tokens are needed for:- Cross-chain bridge liquidity

- Incentivizing relayers and bridge operators

- Long-Term Sustainability

The 20-year vesting model supports gradual distribution, long-term commitment, and adaptability to future changes. - Data Availability (DA) Infrastructure

New tokens will reward Lightclient DA node operators and enable token delegation to support secure data availability infrastructure.

Token Supply Breakdown

All new tokens are allocated to the ecosystem—not the team—and divided as follows:

- Node Rewards: 73,439,930 LUMIA (50.21%)

- Vested over 20 years

- For validators, sequencers, node operators, and delegators

- Ecosystem Rewards: 72,817,703 LUMIA (49.79%)

- Vested over 10 years

- Includes airdrops, grants, liquidity mining, and other initiatives

- Many allocations will be community-governed via LUMIA votes

Vault Addresses for Transparency

- ORN to LUMIA Swap Vault:

0x424Db71F0Ee69137c850A639ce9bfe6c18a8150A - Node Rewards Vault:

0x0Ee999247f3e33406131bC6AA896192Bd40cd6b7 - Ecosystem Rewards Vault:

0xb10B260fBf5F33CC5Ff81761e090aeCDffcb1fd5

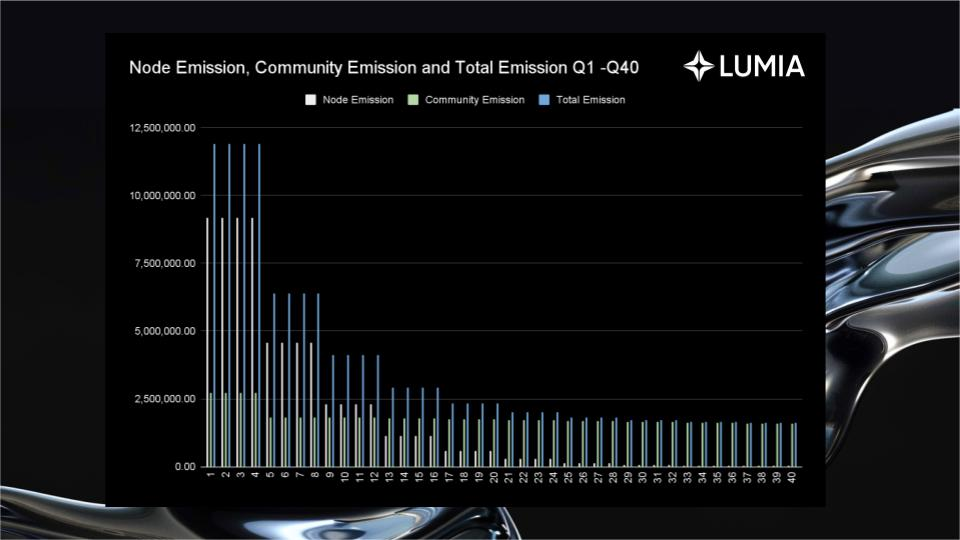

Emission Schedule

- ORN Circulating Supply (Pre-Swap): 92,631,255

- Post-Swap Circulating Supply: 104,541,919

After the token swap, the first 25% of rewards—11,910,664 LUMIA—will enter circulation. The remaining supply will be released quarterly over a 20-year period, ensuring a stable, transparent rollout.

Emission schedule reflects the amount of tokens that are available for utilization, however,, this does not mean tokens will enter circulation. Actual circulating supply consists of node rewards that are not locked for 12-24 months, as well as airdrops/initiatives that are approved by community DAO votes. Circulating supply will be clearly visible on-chain once tokens are distributed from their respective vault, and constantly updated on tracking tools such as CMC amongst others.

Conclusion

The transition from ORN to LUMIA marks a significant milestone in our project's journey. LUMIA is not just a token; it's the fuel that will power the next generation of RWA tokenization and DeFi innovation on Lumia chain. We encourage all ORN holders to participate in this token swap and join us in building a more inclusive and efficient financial ecosystem.

Stay tuned for further announcements and updates regarding the token swap process. Together, we're stepping into a new era of decentralized finance with Lumia chain and LUMIA.